2025 Irmaa Brackets Married Filing Jointly

Blog2025 Irmaa Brackets Married Filing Jointly. Let’s break down what this acronym means. In 2025, the standard part b monthly premium is $174.70.

Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. Here is how you can learn about the change and how to avoid irmaa

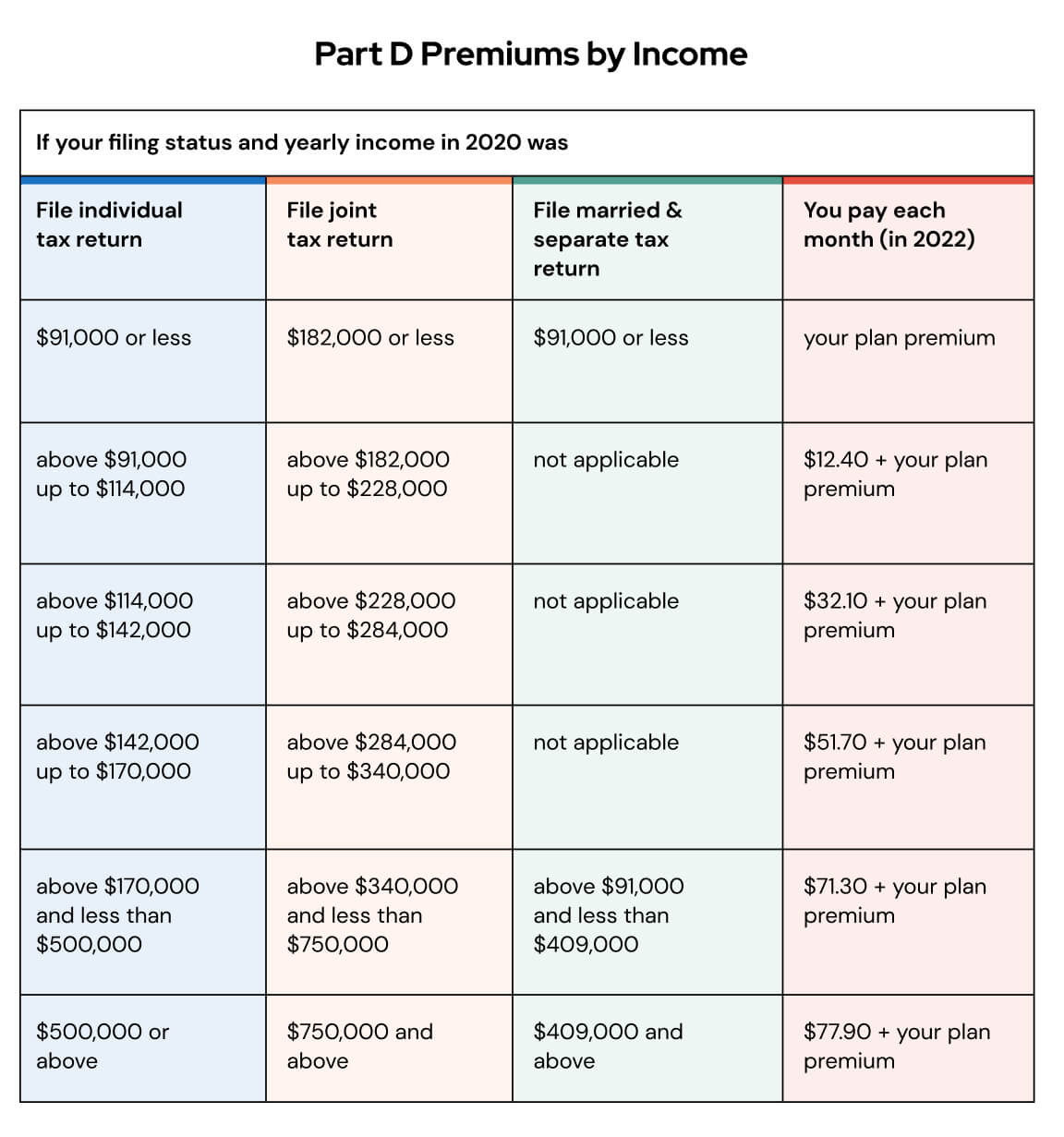

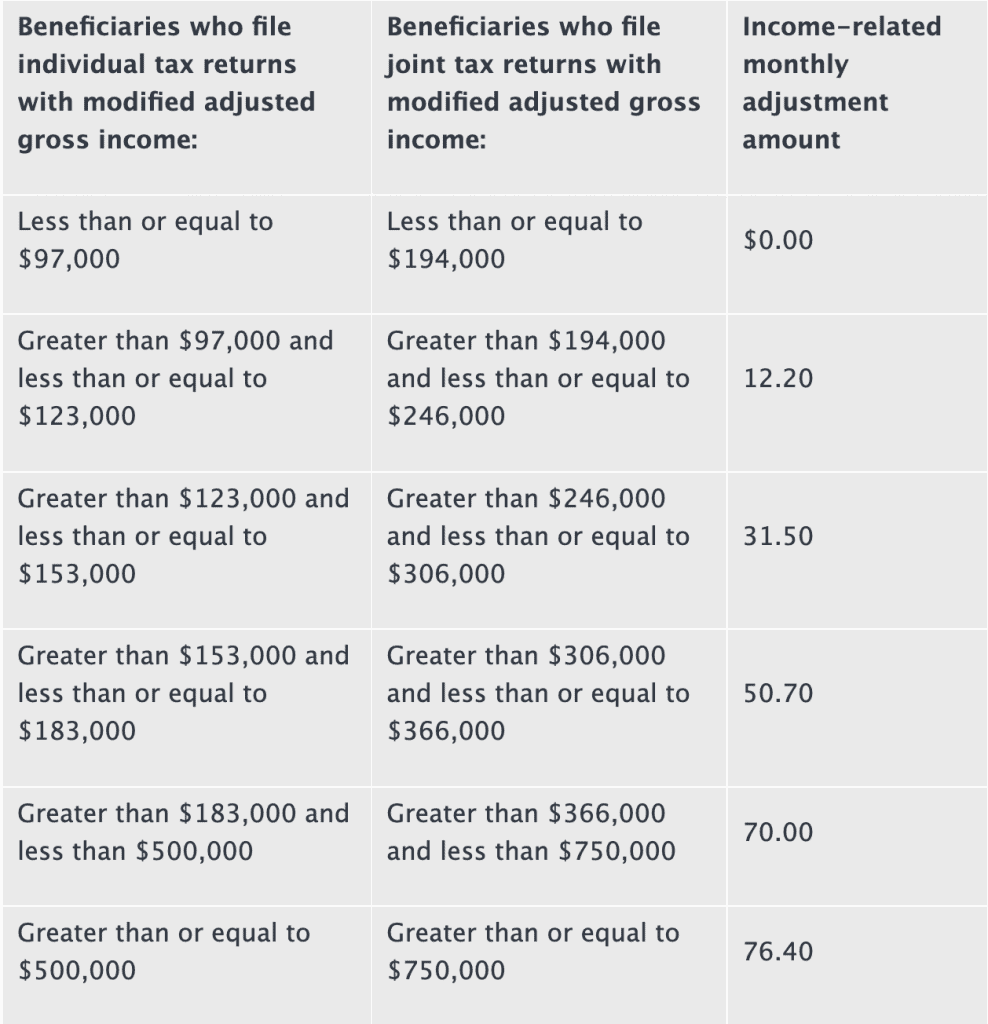

If you file your taxes as “married, filing jointly” and your magi is greater than $206,000, you’ll pay higher premiums for your part b and medicare prescription drug coverage.

Social Security Irmaa Brackets 2025 Mufi Tabina, Here is harry’s predicted irma bracket for 2026 based on 2025 income. The following charts outline irmaa premium brackets based on income levels and tax filing statuses for medicare part b and part d.

IRMAA Related Monthly Adjustment Amounts Guide to Health, The 2025 irmaa brackets by law are going to be larger than 2025. The tax status is broken into:

IRMAA Related Monthly Adjustment Amounts Guide to Health, If your 2025 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard. The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple.

2025 IRMAA Part B Premiums Get Insurance Anywhere, The 2025 irmaa brackets by law are going to be larger than 2025. The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple.

The IRMAA Brackets for 2025 Social Security Genius, For 2025, the irmaa surcharge threshold increased to $103,000. The monthly irmaa rates to be paid by beneficiaries who are married and lived with their spouse at any time during the taxable year, but filed a separate tax return from their.

GMIA, Inc. 2025 Part B Costs and IRMAA Brackets, The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple. In 2025, the standard part b monthly premium is $174.70.

2025 Medicare Part D Irmaa Premium Brackets Janka Melisenda, Medicare recipients with 2025 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay. So, for 2025, the ssa looks at your 2025 tax returns to see if you must pay an irmaa.

Related Monthly Adjustment Amount (IRMAA), Here is harry’s predicted irma bracket for 2026 based on 2025 income. Once you have determined your inputs,.

Form SSA44 An IRMAA Guide For 2025, That means if your income is higher or lower year after. If your 2025 magi was over $750,000, your 2025 part b and part d irmaa costs would be from the highest bracket whether you filed married but separate or.

Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums, The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple. The tax status is broken into:

If you file your taxes as “married, filing jointly” and your magi is greater than $206,000, you’ll pay higher premiums for your part b and medicare prescription drug coverage.